Contents

In this article, we will discuss what EMA is, how to use it in your trading, and what are the benefits and drawbacks of this indicator. As long-term indicators carry more weight, the golden cross indicates abull marketon best trading books of all time the horizon and is reinforced by high tradingvolumes. Remember the basic assumption of technical analysis – markets discount everything. The EMA is more sensitive compared to the SMA and oscillates more with the candles.

EMA, or exponential moving average, is a type of moving average that gives more weight to recent prices in an attempt to make it more responsive to new information. The weighting applied to the most recent price depends on the number of periods in the moving average. There are a few different types of exponential moving averages, but the most common one is the EMA-200. It is also compulsory for advanced-therapy medicines such as gene-therapy, somatic cell-therapy or tissue-engineered medicines and for orphan medicines . The centralised procedure is also open to products that bring a significant therapeutic, scientific or technical innovation, or is in any other respect in the interest of patient or animal health.

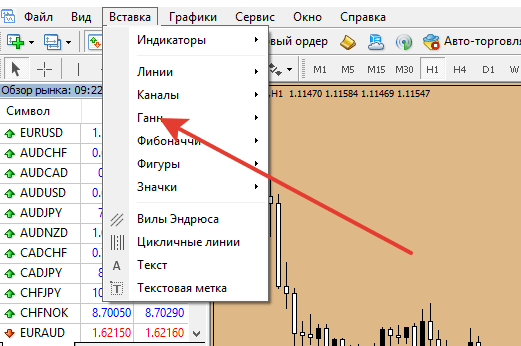

How to use EMA in Binary Options trading

Increases in movement offer buying opportunities for day traders, while decreases in movement signal for the opportunity to sell. When the moving average line tends to move sideways, it tells the day trader to step down as day trading trends are weak and opportunities are limited. A moving average is a technical analysis indicator that helps level price action by filtering out the noise from random price fluctuations. More specifically, the exponential moving average gives a higher weighting to recent prices, while the simple moving average assigns equal weighting to all values. A single evaluation is carried out through the Committee for Medicinal Products for Human Use . If the Committee concludes that the quality, safety and efficacy of the medicinal product is sufficiently proven, it adopts a positive opinion.

A Simple Moving Average would track the movement of price over a specific range of time. An Exponential Moving Average would track the price movement of an asset the same way as well, but it would place more significance on the more recent prices instead of treating them all equally. Moving average convergence/divergence is a momentum indicator that shows the relationship between two moving averages of a security’s price. An EMA does serve to alleviate the negative impact of lags to some extent. Because the EMA calculation places more weight on the latest data, it “hugs” the price action a bit more tightly and reacts more quickly.

Safety updates for authorised COVID-19 vaccines

An EMA reflects quick changes in the price levels of a financial instrument much more quickly than an SMA. Another distinction is that the EMA is somewhat more price-sensitive than the SMA. Compared to the SMA, the high sensitivity of EMA enables traders to see trends more quickly.

- The newest price data will impact the moving average more, with older price data having a lesser impact.

- Traders sometimes watch moving average ribbons, which plot a large number of moving averages onto a price chart, rather than just one moving average.

- As with all technical indicators, there is no one type of average a trader can use to guarantee success.

- A trader could simultaneously activate a 9-EMA, 20-EMA, 50-EMA, 100-EMA, 200-EMA, etc.

- Like all moving average indicators, EMAs are much better suited for trending markets.

To help us improve GOV.UK, we’d like to know more about your visit today. Don’t worry we won’t send you spam or share your email address with anyone. When markets are in a high position of an economy , they form higher highs and higher lows. Yes, it’s really all you need and every week I add a new video with the best setups for the next days. Robert Goodell was a mathematician and a writer who specialized in exponential smoothening.

How EMA works

The European Medicines Agency is a decentralised agency of the European Union responsible for the scientific evaluation, supervision and safety monitoring of medicines in the EU. You should notice how the EMA uses the previous value learn spread trading of the EMA in its calculation. This means the EMA includes all the price data within its current value. The newest price data has the most impact on the Moving Average and the oldest prices data has only a minimal impact.

A trader could simultaneously activate a 9-EMA, 20-EMA, 50-EMA, 100-EMA, 200-EMA, etc. 4 The EMA will appear as a blue line oscillating above and below the Bitcoin candles. We can see that the EMA line moves closely to the candles due to high sensitivity – signaling support and resistance levels for the volatile crypto markets. Support levels are arbitrary price floors where the price is likely to reverse to the upside. Resistance levels are arbitrary price ceilings where the price is likely to reverse to the downside.

EMA’s scientific committees provide independent recommendations on medicines for human and veterinary use, based on a comprehensive scientific evaluation of data. Follow the journey of a medicine for human use assessed by game developer vs software developer salary EMA in this interactive timeline. It explains all stages from initial research to patient access, including how EMA supports medicine development, assesses the benefits and risks and monitors the safety of medicines.

Publications

The EMA is a type of weighted moving average that gives more weighting or importance to recent price data. Like the simple moving average , the EMA is used to see price trends over time, and watching several EMAs at the same time is easy to do with moving average ribbons. More specifically, it coordinates the evaluation and monitoring of centrally authorised products and national referrals, develops technical guidance and provides scientific advice to sponsors. Its scope of operations is medicinal products for human and veterinary use including biologics and advanced therapies, and herbal medicinal products.

However, for this reason, EMA also filters out noisy signals worse than the SMA. If we observe this using the 15-minute chart, we may notice some slight falls in the chart but overall, the price would still be following an upward trend, therefore alluding to buy opportunities. Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

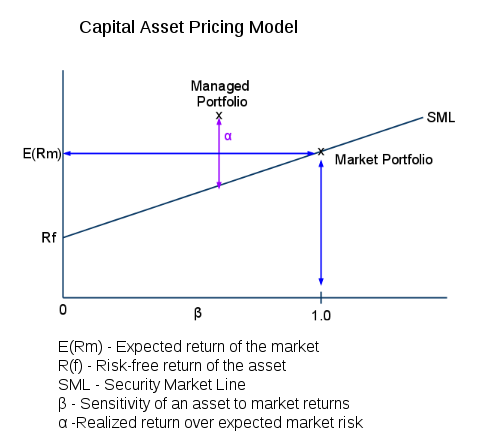

However, if the price level is higher than the EMA line, this indicates that the asset’s worth will continue to rise. As a result, traders can spot buy and sell signals using the EMA as a chart indicator. Technical analysis focuses on market action — specifically, volume and price. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with. Let’s build a scenario in order to further understand how an EMA strategy works. Following an hourly chart that uses a 10-day Exponential Moving Average, we observe the EUR/USD chart.

Placing weight on recent prices makes the EMA more sensitive than indicators such as the SMA. The 10-day Exponential Moving Average over an hourly chart is the best EMA strategy for day traders. It provides the perfect range for a day trader to perfectly analyze the chart in order to predict future TradeAllCrypto Crypto Broker: Company Background price movements. Yet, it is important to note that EMA should never be completely relied on as nothing or no one can 100% guarantee something to go as planned in the future. This is where good risk management comes to ensure your account’s safety against unpredictable price movements.

EMA Crossover Trading

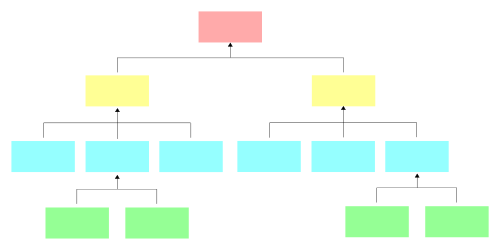

Downtrends are often characterized by shorter moving averages crossing below longer moving averages. Uptrends, conversely, show shorter moving averages crossing above longer moving averages. In these circumstances, the short-term moving averages act as leading indicators that are confirmed as longer-term averages trend toward them. The calculation for the SMA is the same as computing an average or mean.

One popular Fibonacci level is 61.8%, which is often called the “golden ratio” because it’s closely related to how proportions look in nature . Traders will sometimes wait for the price to pull back to this level after a strong move higher and then look for signs of an uptrend resuming before entering into a long position. For example, if the EMA-50 crosses above the EMA-200, it could be a signal that an uptrend is developing.

EMA is a networking organisation whose activities involve thousands of experts from across Europe. There will be many trading strategies as well as notes on how to use EMA in trading that we will present in the following articles. For now, open a DEMO account for yourself and practice to get to know the EMA. + When the price is in an uptrend, the Japanese candlesticks are above the EMA which is pointing up.