Contents

For example, the smallest whole unit move the USD/CAD currency pair can make is $0.0001 or one basis point. Nearly all forex brokers will work all this out for you automatically, but it’s always good for you to know how they work it out. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

In addition to impacting consumers who are forced to carry large amounts of cash, this can make trading unmanageable and the concept of a pip loses meaning. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex, by design, is a high-risk investment—traders should be acquainted with the technicalities. That is, if a currency loses value, imports become Is there any probability to switch cease loss for completed orders more expensive. In such a scenario, customers will not be able to afford imported goods and will be forced to purchase local alternatives.

How to Calculate Pips in Forex

The trader works by using many signals to open trades when the charts point in a certain direction. Thus, forex traders register profits when there is a movement in currency value. For example, if a trader buys EUR/USD at 1.1029, he will make https://1investing.in/ profits only when the EUR rises, i.e., when the quoted currency is traded at a value higher than 1.102. The AUD/CAD currency pair is traded in CAD, with AUD being the so-called base currency and CAD being the so-called quote currency.

Pips cannot be used in every context though, and in an environment of hyperinflation in currencies, exchange rates become difficult to calculate with pips. Hyperinflation refers to a period where prices of goods and services are increasing excessively and in an out-of-control fashion. When FX movements become extremely high, pips lose their utility.

How do I calculate profits and losses with pips?

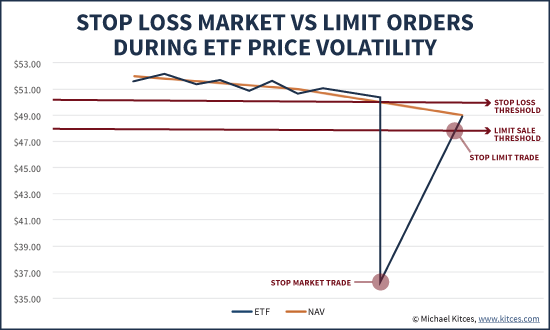

After all, it is a global market and not everyone has their account denominated in the same currency . If the value of the GBP rises against the dollar by 100 pips then we would see a movie like this. In this case, you should set up a stop-loss order to ensure that as soon as the price goes past your predetermined pip value.

This is represented by a single digit move in the fourth decimal place in a typical forex quote. Receive expert’s recommendation on all MAJOR & Cross currency pairs. This service is suitable for all types of traders like Intraday, Swing trading style. In forex, quotes reflect the price of various currencies at any given time.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A pipette represents the fractional of a pip, and has a value of 1/10 of a pip. A combination of hyperinflation and devaluation can push exchange rates to the point where they become unmanageable.

Before trading, you should carefully consider your investment objective, experience, and risk appetite. Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance. If you have read our guide on forex pips all of the way through, you should now have a firm understanding of what the phenomenon means. If so – and you want to try our a pip-based strategy right now, below you will find a list of the best forex brokers to do this with.

Pip calculators explained

Likewise, when the USD/JPY price moves down from 80.55 to 79.78, it is a movement of 77 pips. When the USD/JPY price moves up from 80.55 to 80.87, it is a movement of 32 pips. In recent years, there has been a move to display rates with five decimal places in order to make currency trading attractive for smaller accounts. Experienced traders love our Advantage account with spreads from zero, super-low commissions, and lightning-fast execution.

Having the right information and knowledge about pips is vital to everybody who wants to make it in forex trading. Finally, knowing the Stop Loss of a trade setup helps in determining the perfect position size for that trade in order to stay inside your risk per trade boundaries. By using the following two formulas, you can easily calculate how much profit or loss your position has generated with great precision. The effect of different position sizes on the value of a single pip is shown in the following table.

- Similarly, when a trader makes a profit, it is expressed in PIPs.

- Price movements within the spot forex market are represented in pips.

- MetaTrader 4 is the most widely popular forex trading platform in the space.

- Now instead of using four decimal places to calculate the pip, we are going to use two.

- If the currency you are converting to is the base currency of the conversion exchange rate ratio, then multiply the “found pip value” by the conversion exchange rate ratio.

- Also, forex traders worldwide can comprehend trends using PIP values; it is accepted universally.

Because of this,a pip is usually the last decimal place in a currency pair. 75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Calculating the spread when forex trading is going to be a big part of your long-term strategy. As such, this is where your knowledge of pips and spreads is going to be most useful.

Cosa tenere presente prima di fare trading sul forex

The value of a pip varies based on the currency pairs that you are trading and depends on which currency is the base currency and which is the counter currency. To calculate the USD pip value of a Forex cross pair you should multiply or divide the result by the current exchange rate of the respective major. The JPY-based Forex pairs, the minimum pip is expressed using the second digit after the decimal of the exchange rate – 0.01. During the course of this guide, we are going to use the same examples of currency pairs and rates. It makes it much easier to understand with a level of fluidity and familiarity. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

This guide provides a quick overview of the fundamentals of Forex pip values, Forex pip meaning, what a pip is and how to calculate profits and losses in pips. By the end of this guide, you will understand how to calculate pips when trading forex currency pairs. It is a unit of price movement in the foreign exchange market.

Concept Of Pip In Forex Trading

Divide the size of a pip by the exchange rate and then multiply by the trade value. Trade 5,500+ global markets including 80+ forex pairs, thousands of shares, popular cryptocurrencies and more. It is important to understand the mechanics of how pips are calculated, but it can seem confusing at first. Fortunately, we can access a forex pip calculator to quickly do the math for us.

Add a Comment