Contents

Full access to our intuitive epaper – clip, save, share articles from any device; newspaper archives from 2006. Here are some basic terms that https://1investing.in/ will be helpful to understand F&O. Let us now learn PE and CE Meaning in Share Market and when to purchase and sell them in this article.

Similarly at 10,700, traders will start buying the Nifty futures or heavyweight stocks underlying the index . This will prevent the Nifty from breaking below as people are willing to buy at that level. If a security’s price increases before its exercise date, buying a call option may yield a profit to an investor.

Let’s assume that an investor buys a single put option that was trading at $445, with a strike price of $425 that expires in a month. This trades at a minimum of $10, which is the intrinsic value of the put option. In this case, the investor paid a premium of $2.80 per share.

- In the above example, the buyer of Stock “A”put option won’t exercise the option when the spot is at 4800.

- Thus, making them ideal instruments for successful trading and generating higher profits.

- A bull call spread is an options trading strategy that is aimed to let you gain from a index’s or stock’s limited increase in price.

- The holder will benefit when the underlying asset’s price (i.e., spot price) falls below the strike price.

- The put ratio back spread is also a bearish strategy in options trading.

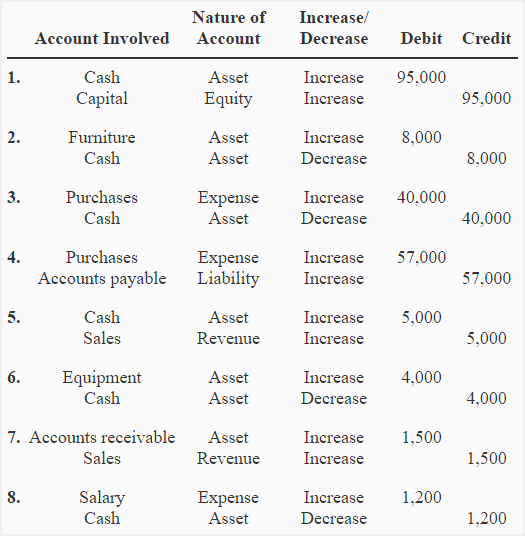

Since they derive their values from an underlying asset, like shares or commodities, they are called derivatives. Two parties enter a derivative contract where they agree to buy or sell the underlying asset at an agreed price on a fixed date. This fixed date is termed the Expiry Date in the stock market. The reason for entering such a contract is to hedge market risks by locking the price of an asset for a future date.

To Read the full Story, Subscribe to ET Prime

There is some standardization for ease of trading in the busiest markets, but the precise details of each transaction is freely negotiable between buyer and seller. An American style option is the one which can be exercised by the buyer at any time, till the expiration date, i.e. anytime between the day of purchase of the option and the day of its expiry. The European kind of option is the one which can be exercised by the buyer only on the expiration day and & not any time before that. A strangle option strategy involves buying call and put options for the same security at the same price and expiry date. Unlike a straddle strategy, there is a directional bias in a strangle options strategy. Exercising an option is to go through with the predetermined action , price, and date.

Futures are contracts which have to be settled once you enter into it. If you enter a futures contract, you are obligated to buy or sell the underlying asset at a pre-specified price on or prior to a certain date. A Future is a contract to buy or sell an underlying stock or other asset at a pre-determined price on a specific date.

Options trading is steadily becoming one of the most popular avenues to create wealth in India. In fact, data suggests that there was a whopping 51% jump in the number of index options traders between June 2020 & March 2021. You could choose to sell a Put Option of the same share for a strike price of 80 expiring 1 month down the line.

Benefits of options trading

When this is the case, the put option has value because the put option holder can sell the Stock “A” at 4400, an amount greater than the current Stock “A” of 4100. Likewise, a put option is out-of-the-money when the strike price is less than the spot price of underlying asset. In the above example, the buyer of Stock “A”put option won’t exercise the option when the spot is at 4800. The put no longer has positive exercise value and therefore in this scenario, the put option holder will allow his “option” right to lapse.

This option trading strategy has a low profit potential if the stock trades above the strike price and exposed to high risk if stock goes down. It is also helpful when What Is Other Comprehensive Income you expect implied volatility to fall, that will decrease the price of the option you sold. The stock or the underlying asset of an option can move in any direction.

Sebi is going to make delivery compulsory in all derivatives over time.

The seller of the call option receives the premium from the buyer. A trader buys a “put” option when he or she holds a bearish view and looks forward to profit from a potential decline in the price of the underlying asset. Like the buyer of a call option, the buyer of a put option also pays a premium to buy the contract. A trader buys a “call” option when he or she believes that the price of the underlying asset will rise.

In this case the investor loses the premium paid (i.e. Rs 25), which shall be the profit earned by the seller of the Put option. In another scenario, if at the time of expiry stock price falls below Rs. 3500 say suppose it touches Rs. 3000, the buyer of the call option will choose not to exercise his option. In this case the investor loses the premium , paid which shall be the profit earned by the seller of the call option. Options on stocks and indices are asymmetric in nature in the sense that the buyer and the seller have different risk-return payoffs.

Popular in Markets

The right time to exit a put option will depend on your position, that is whether you are a buyer or seller. You can sell put option that you have previously bought or repurchase put option that you have previously sold before the expiry date. Unless you offset an option, you haven’t officially exited the trade. A trader sells a “put” option when he or she has a view that the price of the underlying will rise or will remain around the same level.

To succeed in the options field, here are the things you need to know. The contents herein shall not be considered as an invitation or persuasion to trade or invest. NWIL and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit. NWIL also acts in the capacity of distributor for Products such as PMS, OFS, Mutual Funds, IPOs and/or NCD etc. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism.

Even if the price of securities plummets, an investor will only lose a fixed amount. It would restrict any further loss that an investor may otherwise incur. It leads to a generation of higher returns even for a lower investment. The investor may also sell off options with an increase in securities’ price. It enables the investor to make a profit without even having to pay for securities. Put options can be for stocks, bonds, currencies, commodities, indexes, and futures.

What is Options Trading – Table of Contents

To make the most of a fall in the price, you could buy a put option on ABC at the strike price of Rs 930 at a market-determined premium of say Rs 10 per share. This means, you have to pay a premium of Rs 6,000 to purchase one put option on ABC. However, if the index falls below 5,900 levels as expected to say 5,850 levels, you are in a position to make profits from your options contract.

In the case of speculation about an increase in share prices, investors buy these options due to the possibility of improved profits. However, if the price drops below the strike price, option holders stand to lose the amount paid for option agreement as well as premium. The reason that investors use call and put options is largely because of speculation. This is mainly a wager on the direction of future prices of stocks.

Investors can also use options in specific stocks to hedge their holding positions in the underlying (i.e. long in the stock itself), by buying a Protective Put. Thus they will insure their portfolio of equity stocks by paying premium. ESOPs (Employees’ stock options) have become a popular compensation tool with more and more companies offering the same to their employees. ESOPs are subject to lock-in periods, which could reduce capital gains in falling markets; derivatives can help arrest that loss. Covered calls are far less risky than naked calls , since the worst that can happen is that the investor is required to sell shares already owned at below their market value.

Add a Comment